Investing can feel overwhelming when so much rides on every decision and market swings are a constant worry. Yet some investors let professionals take the reins and as a result managed portfolios now oversee over £2 trillion in assets across the UK alone. So while most people obsess over picking every stock on their own, the real difference often comes down to who is guiding the journey—and this approach flips the whole idea of investment control on its head.

Table of Contents

- Defining A Managed Portfolio: Core Concepts

- The Importance Of Managed Portfolios In Property Investment

- Key Components That Make Up A Managed Portfolio

- How Managed Portfolios Function In Real Estate

- The Advantages And Disadvantages Of Managed Portfolios

Quick Summary

| Takeaway | Explanation |

|---|---|

| Managed portfolios optimise financial performance. | These portfolios leverage professional oversight to make informed investment decisions that align with investor goals and risk tolerance. |

| Diversification is crucial in managed portfolios. | A diversified approach across asset classes reduces risk and enhances potential returns, making portfolios more resilient to market fluctuations. |

| Professional management provides strategic insights. | Experienced portfolio managers utilise extensive market knowledge and analytical tools to guide investment strategies effectively. |

| Investors benefit from regular portfolio rebalancing. | Continuous monitoring and adjustment of asset allocations help maintain desired risk profiles and capture opportunities in changing markets. |

| Consider both advantages and limitations carefully. | While managed portfolios offer expert benefits, they may also come with higher fees and less control over individual investments. |

Defining a Managed Portfolio: Core Concepts

A managed portfolio represents a sophisticated investment approach where financial professionals take responsibility for strategically selecting, monitoring, and adjusting investment assets on behalf of an investor. Unlike self-directed investing, these portfolios are crafted with professional expertise, designed to optimise financial performance while carefully managing risk.

The Fundamental Structure of Managed Portfolios

Managed portfolios operate through a structured framework where investment experts leverage their knowledge to make informed decisions. Key characteristics of these portfolios include:

- Professional oversight by qualified financial managers

- Tailored investment strategies aligned with specific financial goals

- Continuous portfolio rebalancing to maintain desired risk profiles

- Diversification across multiple asset classes and investment instruments

The core purpose of a managed portfolio is to provide investors with a hands-off approach to wealth management. Investors entrust their capital to experienced professionals who possess deep market insights and sophisticated analytical tools.

Investment Management Strategies

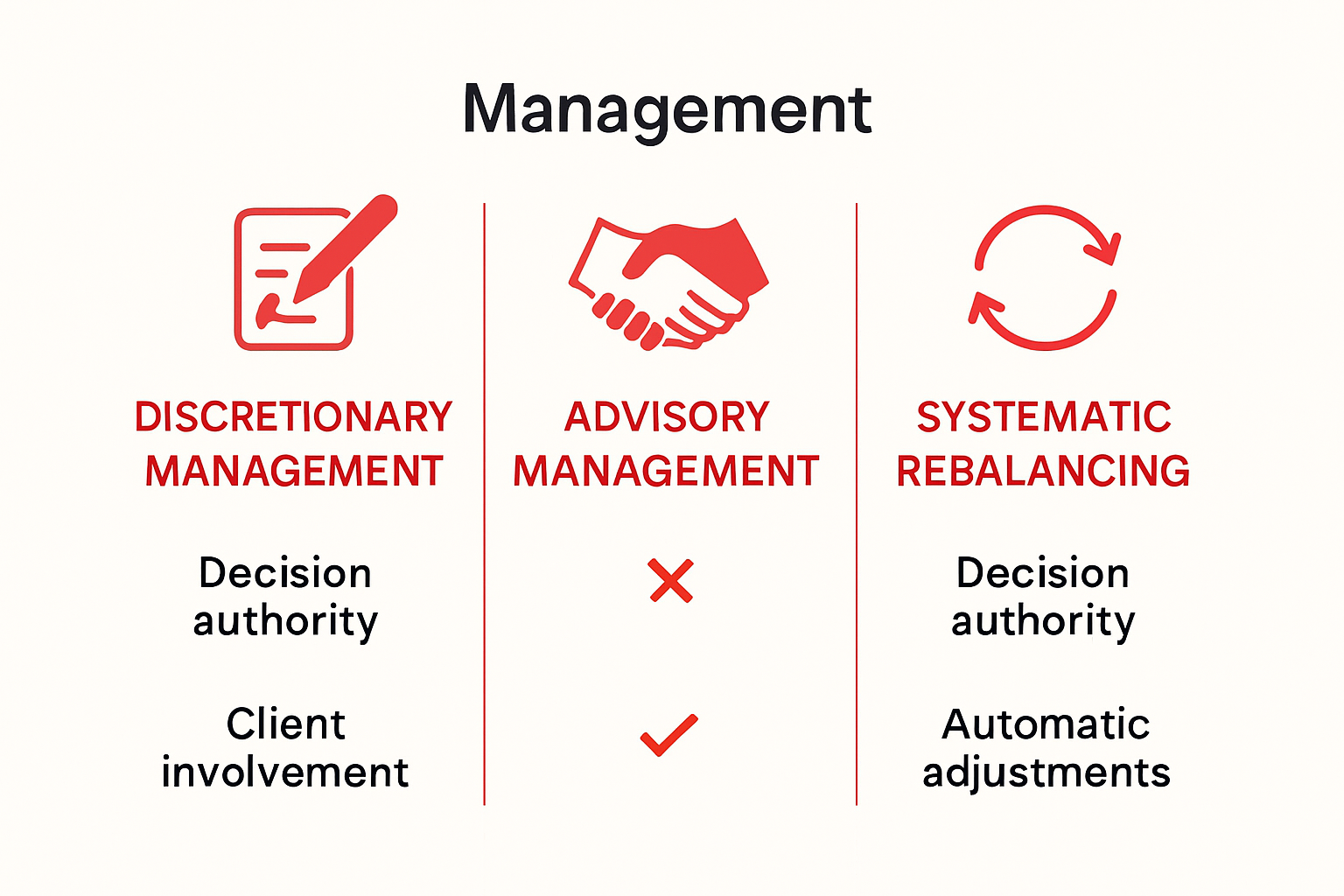

Professional portfolio managers typically employ several strategic approaches to portfolio management. According to the European Union’s Publications Office, these services encompass comprehensive investment portfolio management tailored to individual client needs.

Managers may implement various strategies such as:

- Discretionary Management: Complete authority to make investment decisions

- Advisory Management: Providing recommendations with client approval

- Systematic Rebalancing: Regularly adjusting portfolio allocations

The strategic selection process involves comprehensive analysis of market conditions, economic indicators, and individual investor risk tolerance. This nuanced approach ensures that investment decisions are data-driven and aligned with long-term financial objectives.

Below is a comparison table outlining the primary professional portfolio management approaches referenced in the article, clarifying their defining characteristics and investor involvement.

| Management Approach | Authority Level | Investor Involvement | Key Feature |

|---|---|---|---|

| Discretionary Management | Full decision-making authority | Minimal (manager acts on investor’s behalf) | Manager executes all investment decisions |

| Advisory Management | Recommends, not executes | High (investor must approve actions) | Manager provides guidance, investor retains final say |

| Systematic Rebalancing | Partial (executes pre-set rebalancing) | Moderate (agrees to rules upfront) | Regular adjustments based on agreed criteria |

Ultimately, a managed portfolio transforms complex investment landscapes into structured, professionally curated financial journeys, offering investors peace of mind and potential for optimised returns.

The Importance of Managed Portfolios in Property Investment

Managed portfolios in property investment represent a strategic approach to building and maintaining real estate asset collections that maximise financial performance while minimising inherent risks. These professionally curated investment strategies transform property ownership from a potentially complex endeavour into a structured, optimised financial journey.

Strategic Asset Allocation in Property Investment

Professional portfolio management brings sophisticated expertise to real estate investments. Property portfolio management goes beyond simple asset acquisition, focusing on comprehensive strategic planning that considers multiple economic factors and investment objectives.

Key strategic considerations include:

- Comprehensive market analysis and trend evaluation

- Risk assessment across different property types and geographical regions

- Dynamic portfolio rebalancing to maintain optimal performance

- Identifying emerging investment opportunities

By leveraging professional insights, investors can navigate the intricate landscape of property investments with greater confidence and precision.

Risk Management and Performance Optimisation

According to Urban Land Institute’s research, effective portfolio management involves making strategic decisions that align investments with specific financial objectives while carefully managing associated risks.

The primary advantages of professional property portfolio management include:

- Expertise-driven investment selection

- Systematic approach to asset diversification

- Professional monitoring of market dynamics

- Advanced risk mitigation strategies

Managed portfolios provide investors with a sophisticated mechanism to transform raw property assets into high-performing, strategically positioned investment instruments. By entrusting portfolio management to experienced professionals, investors can achieve more nuanced and potentially more lucrative investment outcomes.

Ultimately, managed property portfolios represent a sophisticated approach to real estate investment, offering investors a structured pathway to building wealth through professional, data-driven asset management strategies.

Key Components That Make Up a Managed Portfolio

A managed portfolio is a sophisticated financial instrument composed of multiple strategic elements designed to achieve specific investment objectives. Understanding these key components provides insight into how professional portfolio managers create robust and dynamic investment strategies.

Asset Allocation Framework

The foundation of a managed portfolio lies in its asset allocation strategy. This critical component determines how investment resources are distributed across different asset classes to balance potential returns and risk exposure. Asset allocation considers multiple dimensions beyond simple financial metrics.

Key aspects of asset allocation include:

- Systematic distribution across equities, bonds, real estate, and alternative investments

- Alignment with investor risk tolerance and financial goals

- Regular rebalancing to maintain desired portfolio composition

- Consideration of macroeconomic trends and market conditions

Professional portfolio managers use sophisticated analytical tools to design allocation strategies that adapt to changing market dynamics while maintaining consistent performance objectives.

Investment Selection and Diversification

According to University of Zurich’s Portfolio Management research, managed portfolios incorporate multiple investment approaches, including academic, fundamental, and quantitative methodologies. These approaches guide the precise selection of individual investment instruments within the portfolio.

Critical selection criteria encompass:

- Comprehensive fundamental analysis

- Evaluation of individual asset performance potential

- Correlation assessment between different investments

- Identification of assets with complementary risk characteristics

The goal of investment selection is not merely to choose high-performing assets but to construct a holistic portfolio that can withstand various market conditions while progressing towards defined financial objectives.

Managed portfolios represent a sophisticated approach to wealth management, transforming individual investment instruments into a cohesive, strategically designed financial ecosystem that responds dynamically to market complexities.

How Managed Portfolios Function in Real Estate

Managed real estate portfolios represent a sophisticated approach to property investment, transforming individual property assets into strategically curated financial instruments. These professionally managed collections extend far beyond simple property ownership, incorporating complex analytical frameworks and strategic decision-making processes.

Strategic Portfolio Construction

Real estate portfolio management involves a comprehensive approach to selecting, acquiring, and maintaining property assets. Unlike traditional property investment, managed portfolios leverage professional expertise to create a holistic investment strategy that considers multiple economic and market factors.

Key strategic considerations include:

- Comprehensive market trend analysis

- Geographic and property type diversification

- Risk assessment and mitigation strategies

- Performance benchmarking against market standards

- Dynamic asset allocation and rebalancing

Professional managers approach real estate portfolios as dynamic financial ecosystems, continuously adapting to changing market conditions and investor objectives.

Performance Optimization Mechanisms

According to Alexandra den Heijer’s research on university real estate portfolios, effective portfolio management requires a sophisticated approach that integrates performance-based strategies with strategic decision-making.

The performance optimization process typically involves:

- Detailed financial performance tracking

- Regular portfolio composition review

- Identification of underperforming assets

- Strategic acquisition and divestment recommendations

- Alignment with broader investment goals

Managed real estate portfolios transform property investments from static assets into dynamic, responsive financial instruments. By applying advanced analytical techniques and professional expertise, these portfolios offer investors a more sophisticated and potentially more lucrative approach to real estate investment.

Ultimately, managed real estate portfolios represent a nuanced approach to property investment, combining professional insights, strategic planning, and continuous performance evaluation to maximize financial potential.

The Advantages and Disadvantages of Managed Portfolios

Managed portfolios represent a nuanced investment approach with distinct benefits and potential limitations. Understanding these multifaceted characteristics enables investors to make informed decisions about whether professional portfolio management aligns with their financial objectives and risk tolerance.

Strategic Advantages of Professional Portfolio Management

Professional portfolio management offers investors a sophisticated approach to wealth creation that extends beyond traditional investment strategies. The primary advantages stem from expert knowledge, comprehensive analysis, and strategic decision-making capabilities.

Key strategic advantages include:

- Professional expertise in market analysis and investment selection

- Systematic risk management and diversification

- Access to advanced analytical tools and research

- Continuous portfolio monitoring and rebalancing

- Personalised investment strategies aligned with individual financial goals

These advantages transform investment from a potentially complex and time-consuming process into a streamlined, professionally managed financial journey.

Potential Limitations and Considerations

According to University of Zurich’s portfolio management documentation, managed portfolios also present certain challenges that investors must carefully evaluate.

Potential disadvantages to consider include:

- Higher management fees compared to self-directed investing

- Potential performance limitations due to management constraints

- Reduced direct control over individual investment decisions

- Possible misalignment with personal investment preferences

- Complexity in understanding comprehensive portfolio strategies

Investors must weigh these potential limitations against the substantial benefits of professional portfolio management. The decision ultimately depends on individual financial goals, risk appetite, and personal investment philosophy.

The following table outlines key advantages and potential limitations of managed portfolios to help readers weigh the pros and cons when considering this investment approach.

| Advantages | Potential Limitations |

|---|---|

| Professional expertise and market analysis | Higher management fees than self-directed investing |

| Systematic risk management and diversification | Reduced direct control over individual investments |

| Access to advanced analytical tools and research | Possible misalignment with personal preferences |

| Continuous portfolio monitoring and regular rebalancing | Complexity in comprehending some portfolio strategies |

| Personalised strategies aligned with financial objectives | Potential performance constraints due to management remit |

Managed portfolios offer a sophisticated alternative to traditional investing, providing professional expertise and strategic insights while requiring investors to carefully assess their unique financial landscape and investment objectives.

Turn Complex Property Management Into Effortless Gains With Professional Expertise

Navigating the world of managed portfolios often highlights a simple truth: the search for reliable returns and hands-off performance can quickly become overwhelming without the right partner. As discussed in the article, professional oversight, systematic risk management, and tailored strategies are critical for true peace of mind. Yet, achieving this level of clarity in property investment can be challenging if you lack trusted, all-in-one operational support. Are you ready for a solution that brings both consistent results and confidence?

Let Guestly Homes transform your property assets into a managed portfolio experience defined by trust and predictability. Choose between our Revenue Share or Arbitrage models for tailored, fully managed results. Discover how our expert solutions unlock long-term profitability and support your goals with zero day-to-day friction. Explore your next step toward a future where performance meets true peace of mind. Visit our main site and see what your property can achieve today.

Frequently Asked Questions

What is a managed portfolio?

A managed portfolio is an investment strategy where financial professionals take responsibility for selecting, monitoring, and adjusting assets on behalf of investors, optimising performance while managing risk.

What are the key benefits of using a managed portfolio?

The primary benefits include professional oversight by qualified managers, tailored investment strategies aligned with financial goals, continuous portfolio rebalancing, and enhanced diversification across multiple asset classes.

How does professional portfolio management improve investment performance?

Professional portfolio management enhances investment performance through expert market analysis, systematic risk management, access to advanced analytical tools, and personalised investment strategies that align with individual financial objectives.

What are the potential disadvantages of managed portfolios?

Potential disadvantages include higher management fees compared to self-directed investing, reduced control over investment decisions, and the complexity of understanding comprehensive portfolio strategies.